It marks Singapore's long-planned leadership transition to 4G political team

PM Lee to stay on as Senior Minister; any major Cabinet changes will come after General Election: Lawrence Wong

By Tham Yuen-C, Senior Political Correspondent, The Straits Times, 16 Apr 2024

Singapore will have a new prime minister on May 15, with Deputy Prime Minister Lawrence Wong set to take over from Prime Minister Lee Hsien Loong on that day.

The date for the handover was announced in a statement from the Prime Minister’s Office (PMO) on April 15, a key detail in Singapore’s long-planned leadership transition from the third-generation to the fourth-generation (4G) political team.

When he is sworn in at 8pm on May 15 at the Istana, DPM Wong, who entered politics 13 years ago, will be Singapore’s fourth prime minister.

In a video message put up shortly after the announcement, DPM Wong said he had never expected to be asked to serve as prime minister one day when he first agreed to enter politics in 2011.

“I accept this responsibility with humility and a deep sense of duty. I pledge to give my all in this undertaking,” he said.

“Every ounce of my energy shall be devoted to the service of our country and our people. Your dreams will inspire my actions, your concerns will guide my decisions.”

PM Lee said on his social media pages that leadership transition is a significant moment for any country.

“Lawrence and the 4G team have worked hard to gain the people’s trust, notably during the pandemic,” he said. “Through the Forward Singapore exercise, they have worked with many Singaporeans to refresh our social compact and develop the national agenda for a new generation.”

PM Lee said the 4G team is committed to keeping Singapore working well and moving ahead, and asked that Singaporeans give DPM Wong and his team their full support to jointly create a brighter future.

DPM Wong, who is 51, had been the presumptive next prime minister since April 2022, when he was picked by his peers as the leader of the People’s Action Party’s (PAP) 4G team.

Before DPM Wong, who is also Finance Minister, emerged as leader, former minister Khaw Boon Wan had spoken individually to the 4G leaders and other members of the Cabinet to move along the process of finding a successor for PM Lee. Mr Khaw revealed that 15 out of the 19 he had spoken to had put DPM Wong as their top choice.

It capped a period of uncertainty in Singapore’s leadership succession.

A year before, in April 2021, Deputy Prime Minister Heng Swee Keat – originally earmarked for the job by his 4G peers in November 2018 – had stepped aside to pave the way for a younger person to lead the country. He was going to turn 60, and the Covid-19 pandemic, which began in 2020, had shortened his runway as the next prime minister, he had explained.

The pandemic, meanwhile, was also what helped DPM Wong come into prominence, pundits had said.

As co-chair of the multi-ministry task force on Covid-19, DPM Wong had been front and centre in Singapore’s fight against the pandemic, along with Health Minister Ong Ye Kung and Trade and Industry Minister Gan Kim Yong.

His assured manner during the task force’s many media conferences and ability to break down issues simply had gained him admirers.

The usually business-like minister also showed a gentler side, choking back tears as he thanked healthcare and other front-line workers during a speech in Parliament at the height of the crisis.

PM Lee, 72, later said that his younger colleague and the 4G team had “earned their spurs” during the pandemic. The baptism of fire they went through put paid to worries that the team would have only a short time to forge bonds and learn to work together before having to take over.

Since then, DPM Wong and his team had gone on to take on more responsibilities, chief among them spearheading the Forward Singapore exercise to forge a new social compact with Singaporeans.

The team’s report, put out in October 2023, set the public agenda for the years ahead. It called on Singaporeans to partner the Government in developing a fair, caring and inclusive society with people progressing together.

While the Forward Singapore report has been described as a continuation of the work of the Government, there are signs that the new team will go further than their predecessors, as signalled by policy shifts such as the forthcoming introduction of unemployment assistance.

The coming into power of the 4G team also happens at a more troubled time for the world, with wars raging in Europe and the Middle East, and uncertainty in the global economy.

Amid this, Singapore is restructuring its economy for the future.

While there have been positive signs that Singapore’s economy will do better in 2024 than it did last year, more layoffs are expected due to rising costs and greater automation. Overall growth for 2024 is projected to be between 1 per cent and 3 per cent.

In many developed countries, rising inequality and slowing mobility have also divided people, and a key plank of the 4G team’s agenda has to do with strengthening bonds between people through sports, the arts and philanthropy in order to build national resilience.

With DPM Wong taking over before August, he will have the National Day Rally to lay out his plans for the year ahead. He also has his work cut out as he prepares his party for the next general election (GE).

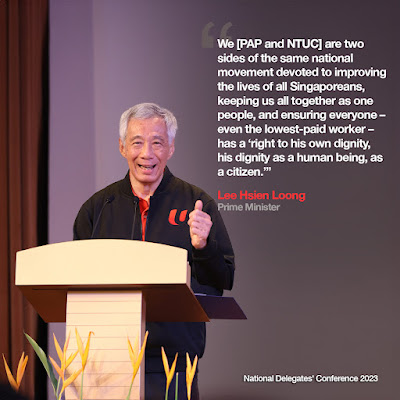

At the biennial PAP convention held at the Singapore Expo in November 2023, PM Lee, who has been prime minister for 20 years, made his intention clear that he wanted to hand over to DPM Wong before the next general election, due by November 2025.

DPM Wong, on his part, signalled his readiness for the task. Speaking to a hall full of his party’s members, he said: “I am ready for my next assignment.”

The handover announcement sparked an outpouring of tributes from both political office-holders and backbencher MPs on PM Lee’s two decades as head of government. Many, like DPM Heng, reflected on PM Lee’s role in building a Singapore that is cohesive and future-oriented.

PM Lee will relinquish his role on May 15, and is required under the Constitution to inform President Tharman Shanmugaratnam of his decision to step aside.

He will also formally advise the President to appoint DPM Wong as his successor, said the PMO.

At the PAP convention in November 2023, PM Lee had said he will be at the new prime minister’s disposal after he steps down.

Giving an indication of his possible next steps, he had said: “I will go wherever he thinks I can be useful. I will do my best to help him and his team to fight and win the next GE. I want to help him to fulfil his responsibilities leading the country so that Singapore can continue to succeed beyond me and my 3G colleagues, for many years to come.”